Dutch Investment Obligation

This English translation is for information purposes only. In case of any discrepancies, the Dutch version will prevail. View the Dutch version of this page here.

With an effective date of 1 January 2024, the Dutch investment obligation (the ‘investment obligation’) requires certain audiovisual media service providers to invest in Dutch cultural audiovisual products every year. The purpose of the investment obligation is to strengthen the quality and supply of Dutch cultural audiovisual products by generating additional resources for their production and exploitation.

The investment obligation applies to media service providers that provide one or more on demand audiovisual media services. The services fully or partially target the audience in the Dutch territory and the media service provider generates revenue in the Netherlands that is related to the provision of the relevant services. The investment obligation applies to providers of on demand audiovisual media services that operate in the Netherlands, including providers that are established in other Member States of the European Union and whose services target the audience in the Dutch territory.

The investment obligation does not apply to every media service provider that provides an on demand audiovisual media service. Only media service providers that generate ‘relevant annual revenue’ from each on demand audiovisual media service of €10 million or more in any given financial year are subject to this obligation. They must invest 5% of this revenue in Dutch cultural audiovisual products.

Supervision of the investment obligation

As the Commissariaat voor de Media (‘Dutch Media Authority’; the ‘Authority’) oversees compliance with the Dutch Media Act 2008 (Mediawet 2008; the ‘Media Act’), the Authority is charged with the supervision of compliance with the investment obligation.

The Media Act contains an obligation for media service providers to submit annual reports to the Authority. Media service providers must annually account to the Authority for the previous financial year before 1 July of the next year. For the first year in which media service providers account to the Authority (reporting for the financial year 2024), the date for supplying the information has been changed to 1 October 2025.

Under certain circumstances, an exemption from the investment obligation may be obtained. The Authority has the statutory power to grant media service providers an exemption from the investment obligation under exceptional circumstances (Article 3.29e(6) of the Media Act).

Reporting obligations

The Authority asks media service providers to submit the necessary report(s) for the investment obligation every year. All relevant information for complying with this obligation is provided below.

Instruction for supplying information in relation to the investment obligation

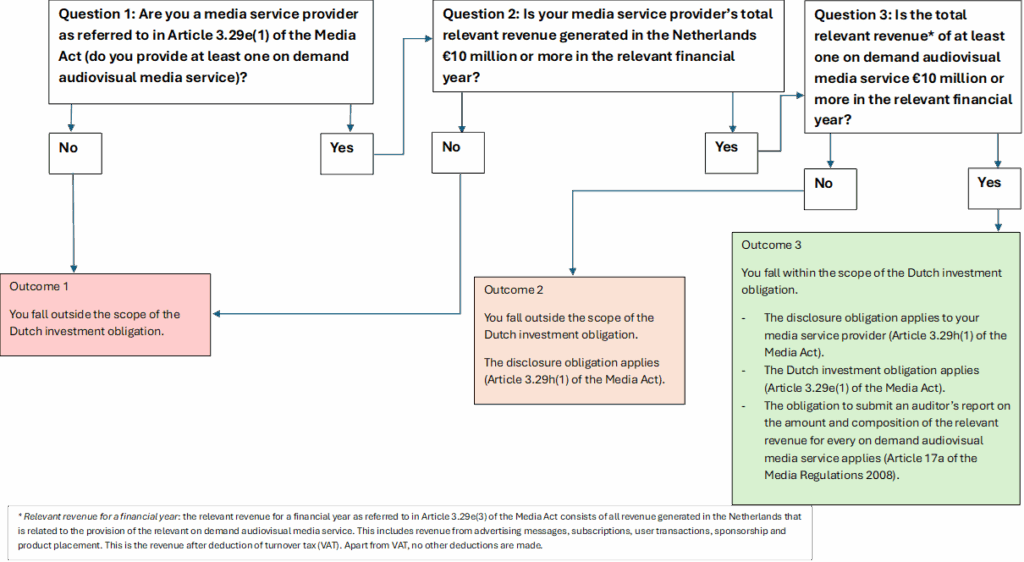

A number of factors determine what information you, as a media service provider, need to provide to the Authority. Below, you will find a decision tree to help you. This decision tree is also included in the ‘Manual for the Financial Reporting of Relevant Revenue within the Framework of the Dutch Investment Obligation’ (the ‘Manual’). Go through it step by step to decide which criteria apply to you and which reports you are required to submit.

In the text below, we explain for every possible outcome what information you, as a media service provider, need to supply (by way of illustration, for the financial year 2024). The possible outcomes (1, 2 or 3) correspond to the outcomes included in the decision tree.

Outcome 1: The Dutch investment obligation does not apply to the media service provider.

This is the case if your media service provider provides at least one on demand audiovisual media service, but the media service provider’s total revenue generated in the Netherlands in financial year 2024 amounted to less than €10 million.

Outcome 2: The Dutch investment obligation does not apply to the media service provider, but the media service provider must report on the composition and amount of the relevant revenue.

This is the case if your media service provider provides at least one on demand audiovisual media service and the media service provider’s total revenue generated in the Netherlands in financial year 2024 amounted to €10 million or more. The relevant revenue for each on demand audiovisual media service, by contrast, was less than €10 million in financial year 2024.

Disclosure obligation in relation to the Financial Reporting Document – Relevant Revenue

- Your media service provider fills in the ‘Financial Reporting Document – Relevant Revenue’ for financial year 2024 completely and truthfully and then submits it to the Authority.

Informatieverplichting ten aanzien van de Financiële verantwoording relevante omzet.

- Uw media-instelling vult voor boekjaar 2024 het ‘Financieel verantwoordingsdocument relevante omzet’ volledig en naar waarheid in en dient deze vervolgens in bij het Commissariaat.

Outcome 3: The Dutch investment obligation and the corresponding disclosure obligations apply to the media service provider.

This is the case if your media service provider provides at least one on demand audiovisual media service and the relevant revenue of at least one on demand audiovisual media service amounted to €10 million or more in financial year 2024.

The following disclosure obligations apply to your media service provider. The Authority has stated for every obligation what information it expects to receive.

1. Disclosure obligation in relation to the Financial Reporting Document – Relevant Revenue

- Your media service provider fills in the ‘Financial Reporting Document – Relevant Revenue’ for financial year 2024 completely and truthfully and then submits it to the Authority.

- The ‘Financial Reporting Document – Relevant Revenue (financial year 2024)’ is accompanied by the corresponding external auditor’s report and has been certified by the auditor (by means of initials and a stamp).

2. Disclosure obligation in relation to compliance with the investment obligation

- Your media service provider fills in the ‘Reporting Form – Investment Obligation (financial year 2024)’ for financial year 2024 completely and truthfully and then submits it to the Authority.

Your media service provider will submit three documents in total to the Authority for financial year 2024:

- Financial Reporting Document – Relevant Revenue (financial year 2024);

- Auditor’s report (financial year 2024);

- Reporting Form – Investment Obligation (financial year 2024).

Documents

1. Frequently Asked Questions (FAQ)

The Authority has prepared an FAQ document (Frequently Asked Questions) for media service providers, which answers the most frequently asked questions about the regulations. The purpose of the document is to remove any uncertainty and facilitate compliance with the Media Act and the corresponding regulations.

Evolving or changed insights of the Authority may result in future amendments to the document, for example in response to experiences from practice. The most recent version of the document is available below.

Frequently Asked Questions (FAQ)

2. Manual for the Financial Reporting of Relevant Revenue within the Framework of the Dutch Investment Obligation

Drawn up within the framework of the investment obligation, the Manual for the Financial Reporting of Relevant Revenue supports media service providers in preparing the ‘Financial Reporting Document – Relevant Revenue’ in accordance with the applicable laws and regulations.

Manual for the Financial Reporting of Relevant Revenue

3. Audit Protocol for the Financial Reporting Document – Relevant Revenue

The Audit Protocol for the Financial Reporting Document – Relevant Revenue has been drawn up to provide indications on the scope and depth of the auditor’s work during the audit of the Financial Reporting Document – Relevant Revenue.

Audit Protocol for the Financial Reporting Document – Relevant Revenue

4. Financial Reporting Document – Relevant Revenue

The document in which the media service provider will include such information as the composition and amount of the relevant revenue for every on demand audiovisual media service. The Financial Reporting Document – Relevant Revenue is part of the Manual for the Financial Reporting of Relevant Revenue within the Framework of the Dutch Investment Obligation.

Financial Reporting Document – Relevant Revenue

5. Reporting Form – Investment Obligation

The media service provider must then invest 5% of the relevant revenue for the relevant financial year in Dutch cultural audiovisual products. On the Reporting Form – Investment Obligation, the media service provider will state, among other things, what investments were made in the relevant financial year and how the Dutch investment obligation was complied with.

Reporting Form – Investment Obligation

Reporting cycle and time limits

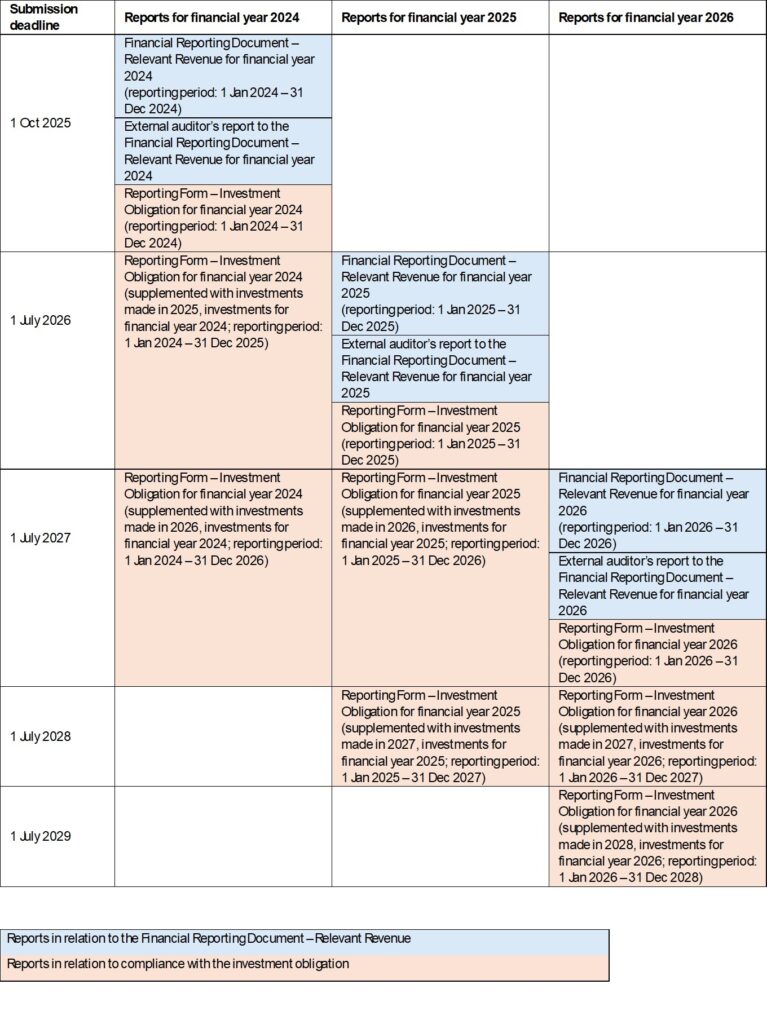

All media service providers that are subject to a statutory reporting obligation will report according to the schedule below. Explanation of the schedule:

- All information in the schedule is based on a financial year that coincides with a calendar year.

- The investment obligation has been in force since 1 January 2024. Media service providers must annually report to the Authority for the previous financial year before 1 July of the next year. For the first year (financial year 2024) in which media service providers report to the Authority, the date for supplying the information has been changed to 1 October 2025.

- Article 3.29g(1) of the Media Act provides that the investment must be made within two financial years from the end of the financial year in which the relevant revenue was generated. If a media service provider has invested less than the required 5% of its relevant revenue in Dutch cultural audiovisual products in any given financial year, the Authority will request that the report for that financial year be supplemented in the next year until the obligation to invest 5% is complied with.

- By way of illustration (financial year 2024): if a media service provider’s investments made in 2024 do not fully comply with the obligation to invest 5% of its relevant revenue for financial year 2024, when submitting a report before 1 July 2026 the media service provider is permitted to supplement the 2024 reporting form with investments made in 2025, as long as these investments were made with a view to complying with the obligation for financial year 2024.

Secure file sharing (Filecloud)

The Authority treats company data and personal data of media service providers in confidence. To ensure that files are shared securely with the Authority, we use an online storage location within the Filecloud cloud service. The document below explains the steps that you, as a media service provider, should follow to share your files with the Authority.

Manual secure file sharing (Filecloud)

Compliance with the investment obligation

The investment obligation pertains to media content that qualifies as a Dutch cultural audiovisual product. Article 3.29f of the Media Act provides the definition that the legislature gives to the term ‘Dutch cultural audiovisual products’:

“Dutch cultural audiovisual products are European works within the meaning of Article 1(n) of the European Directive, not being the reporting or presentation of one or more sporting events or sporting competitions, which meet at least two of the following conditions, at least one of which is the condition mentioned in a or b:

a. at least 75% of the scenario has been written in Dutch or Frisian;

b. the main characters speak Dutch or Frisian for at least 75% of the time;

c. the scenario is based on an original literary work in Dutch or Frisian;

d. the central theme is related to Dutch culture, history, society or politics.”

This means that productions need to meet at least two of the four language and culture criteria, which in any event includes one of the conditions mentioned in ‘a’ or ‘b’.

Investment period

The amount of the investment to be made is calculated every financial year. The investment must be made within two financial years from the end of the financial year for which the relevant revenue was calculated. This means that the percentage of the relevant revenue for 2024 to be invested must be invested no later than the end of 2026. If a provider invests more than it is required to invest in a single financial year – 5% of the relevant revenue – it will use the excess amount invested to comply with the investment obligation for the next financial year. The explanation states that the surplus of a single financial year cannot be deducted from the investment for financial years other than the next financial year.

Forms of investment

Providers may invest in Dutch cultural audiovisual products in various ways. They may do so by investing in productions or co-productions or by acquiring exploitation licences for productions that have not been completed or that have recently been completed. An exploitation licence is a licence to offer a production, whether or not temporarily or exclusively. If an exploitation licence is obtained for a completed production, the production may not be older than four years at the time the licence is obtained.

The Explanatory Memorandum to the amendment to the Media Act introducing an investment obligation also clarifies that other investment options – such as promotion, talent development, digitisation and subtitling – are excluded from the investment obligation. The purpose of the investment obligation is primarily to generate additional resources for the production and exploitation of Dutch cultural audiovisual content. Other ways to invest serve this purpose indirectly or would render the scheme overly complex because an objective review framework for these forms of investment is lacking.

Finally, the legislature leaves the investment method to the market, within the framework of the forms of investment described above. The Explanatory Memorandum states that providers may choose to invest in Dutch cultural audiovisual products either directly or through a private fund.

At least half of the products qualify as documentary films, documentary series, drama series or motion pictures

In addition to the mandatory language and culture criteria, at least half of the amount to be invested must be used for Dutch cultural audiovisual products that qualify as documentary films, documentary series, drama series or motion pictures. The legislature has added these terms to Title 3.2a of the Media Act on on demand audiovisual media services, emphasising that the categories of documentary films, documentary series, drama series and motion pictures allow various genres. This means that films and series may include popular films, children’s films and family films, romantic comedy films, fantasy films, horror films, action films, thrillers, musical films, crime films and science fiction films.

Independent productions

At least 60% of the amount to be invested must be used for independent productions. The term ‘independent productions’ is defined in line with the existing definition in the Media Act (Article 3.22(1) of the Media Act). An order in council may provide that other media content will also be regarded as an independent production.

The investment has demonstrably been made

The productions do not have to be completed in the investment period, as long as the investment has demonstrably been made. The legislature considers that the investment has demonstrably been made when the provider has concluded the underlying agreement for the investment or for acquiring the exploitation licence or, if an investment in a production or co-production is involved, has demonstrably used the amount to be invested to comply with the investment obligation in another way.

The new Article 17a of the Media Decree 2008 (Mediabesluit 2008) sets rules for the consequences of any termination of or non-compliance with such an agreement and of situations where the amount to be invested is no longer demonstrably used to comply with the investment obligation in another way.

Contact

Please contact the Authority’s Supervision department if you have any questions about the investment obligation. The contact details of the Supervision department are as follows:

- Telefoon: 035-7737700

E-mail: cvdm@cvdm.nl